Financial Risk Management Software is a tool used by organizations to identify, assess, monitor, and mitigate financial risks. These risks can include anything from market fluctuations and credit risks to operational and liquidity risks. The software helps in analyzing potential financial threats and opportunities, allowing companies to make informed decisions to protect their assets and ensure stability.

Here are some key features and functions typically found in such software:

- Risk Assessment and Measurement: Evaluates potential risks using statistical models and historical data. It often includes Value at Risk (VaR), stress testing, and scenario analysis.

- Portfolio Management: Helps in optimizing investment portfolios by assessing risk and return metrics. It aids in diversification and rebalancing strategies.

- Credit Risk Management: Analyzes the creditworthiness of borrowers or counterparties and monitors credit exposure.

- Market Risk Management: Assesses risks arising from market movements, such as fluctuations in interest rates, exchange rates, and commodity prices.

- Operational Risk Management: Identifies and mitigates risks related to internal processes, people, and systems.

- Reporting and Analytics: Provides tools for generating reports, dashboards, and analytics to help in decision-making and risk communication.

- Scenario Analysis and Stress Testing: Models different scenarios and stress tests to evaluate how extreme conditions could impact the financial stability of the organization.

- Integration with Other Systems: Often integrates with other financial systems, like accounting or trading platforms, to provide a comprehensive view of risk.

Financial risk management software is crucial for helping organizations navigate the complexities of financial markets and ensure they can withstand adverse conditions while capitalizing on opportunities.

Seon

Seon – frictionless real-time fraud prevention and AML compliance using advanced digital footprinting, fully customisable rules and machine learning.

- Secure Your Onboarding

- Monitor User Activity In Real-Time

- Analyze AI-Driven Insights

- Consolidate Compliance In One Platform

Oracle

Oracle Financial Services Risk Management establishes a single measure of risk across your financial services organization that provides a comprehensive view of performance.

- Appraise and consolidate risk across the enterprise

- Enhance resilience using intensive stress testing

- Get a single source of truth for risk assessment

Logicmanager

Financial institutions and banks can protect against financial and reputational losses with LogicManager’s industry-leading enterprise risk management software.

- Simplify all of your financial reporting responsibilities with our powerful SOX Compliance Software

- Track all regulatory compliance requirements including FFIEC, FDIC, OCC, CFPB, Basel II, and other standards

- Operationalize your cybersecurity efforts to prevent breaches with our intuitive IT Security & Governance solution

- Identify the most critical risks in every part of your organization and allocate resources effectively with pre-built self-assessments

360factors

360factors has integrated AI in financial services compliance and risk management solutions, offering a streamlined approach to compliance and risk management.

- Automates repetitive tasks such as data collection, analysis, and reporting

- Streamline workflows across different departments and functions within your financial institution

- Ensure real-time monitoring of regulatory changes, compliance status, and risk indicators, receiving alerts and notifications for potential issues or violations to address them promptly

- Identify and assess various types of risks more accurately. Prioritize risks based on severity and likelihood, facilitating better decision-making and resource allocation

Riskonnect

Riskonnect risk management software helps financial services organizations manage risk, protect private information, and comply with strict regulations.

- Everything you need to identify, manage, and mitigate risk is all in one, easily accessible place

- Routine processes are streamlined and automated so you can spend your time where it matters most

- Riskonnect gives you the intelligence to identify and respond to evolving risk, stay compliant across the board, and make informed decisions that will add value to the business

Orases

Orases – software is designed to offer a holistic approach to managing various financial risks, enabling firms to achieve stability and informed growth.

- Integrated Risk Management Framework

- Predictive Risk Analytics

- Real-Time Risk Monitoring

- Automated Compliance Reporting

- Customizable Dashboards

- Climate Risk Analytics

- Credit Risk Evaluation

- Market Risk Valuation

- Liquidity Risk Management

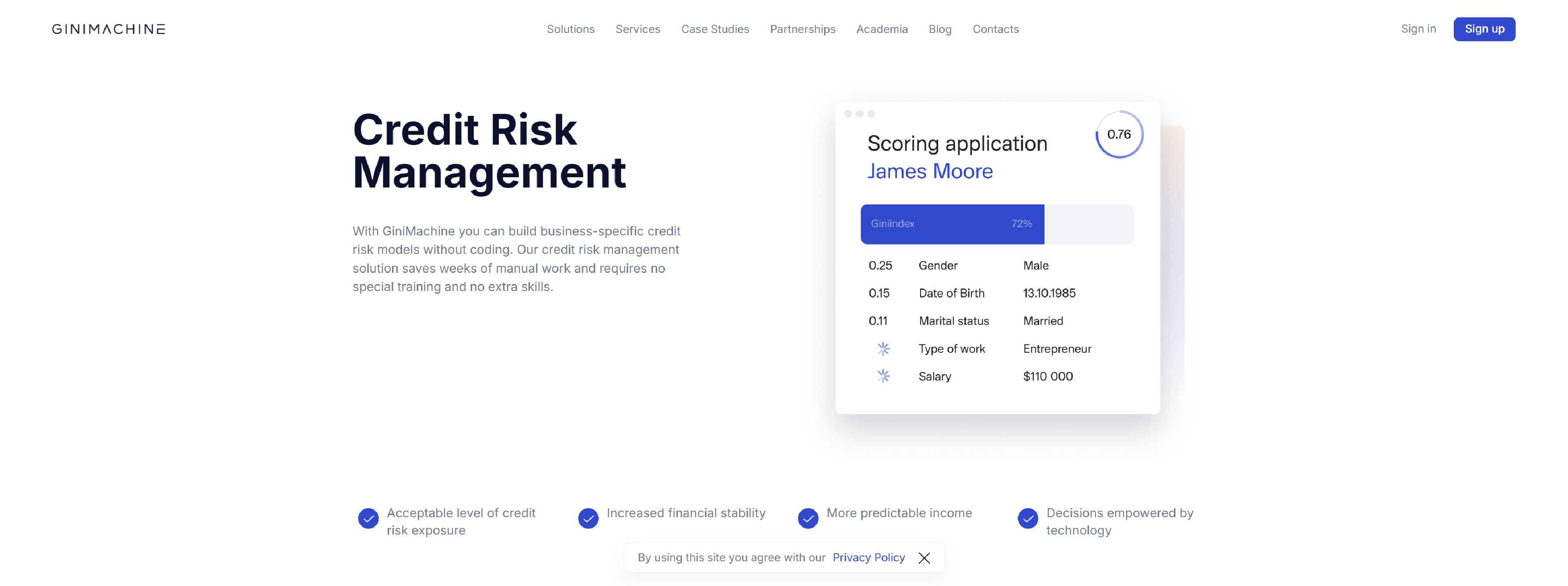

Ginimachine

GiniMachine AI is a full-scale software for credit risk management. Build, validate, and deploy high-performing credit risk models automatically.

- Works with any kind of data, both structured and unstructured. It builds, validates, and deploys models in 2-10 minutes

- Provides proven economic efficiency – fewer NPLs, higher acceptance rate, better performance of a loan portfolio

- Requires no special training, helps to save time, and to reduce labor costs.

Sas

No matter how your financial institution prioritizes enterprise risk management, SAS has proven methodologies and best practices to help you establish a risk-aware culture, optimize capital and liquidity, and meet regulatory demands.

- Improve regulatory compliance and instill powerful balance sheet management capabilities

- Deploy a broad range of scalable credit models to continuously manage your loan portfolios

- Simulate over multiple scenarios. Produce results faster with a richer analysis to inform business decision making

- Execute the entire ECL process in a substantially reduced time frame using a controlled, high-performance environment

- Proactively govern risk management processes to achieve business and regulatory goals

- Adopt a single, integrated framework for IFRS 17 and Solvency II compliance – and beyond

Oxagile

Oxagile – experts in developing financial risk management software, we’ll help you protect your mission-critical data against fraud and avoid costly downtime.

- Accurate sales forecast

- Advanced financial market analysis

- Comprehensive interest rates research

- Extensive investment risk analysis

Most Common Questions Regarding Financial risk management software

Q: What is financial risk management software?

A: Financial risk management software is a tool designed to help organizations identify, assess, and mitigate financial risks. It enables users to analyze various types of financial risks such as market, credit, operational, and liquidity risks, and to implement strategies to manage these risks effectively.

Q: Why is financial risk management important?

A: Financial risk management is crucial because it helps organizations anticipate and prepare for potential financial losses, ensure regulatory compliance, protect assets, and maintain financial stability. Effective risk management minimizes the impact of adverse events on the organization’s financial health and supports strategic decision-making.

Q: What are some key features of financial risk management software?

A: Key features typically include:

- Risk assessment and measurement tools (e.g., Value at Risk, stress testing)

- Portfolio management and optimization

- Credit risk analysis

- Market risk analysis

- Operational risk management

- Regulatory compliance tracking

- Reporting and analytics

- Scenario analysis and stress testing

- Integration with other financial systems

Q: How does financial risk management software work?

A: The software uses algorithms, statistical models, and historical data to evaluate potential risks. It generates reports and visualizations to help users understand their risk exposure. It often includes tools for modeling various scenarios and stress-testing to predict how different factors might impact financial outcomes.

Q: Who uses financial risk management software?

A: Financial risk management software is used by a wide range of professionals, including:

- Risk managers

- Financial analysts

- Portfolio managers

- Compliance officers

- CFOs and finance departments

- Investment managers

Q: What are some common types of financial risks managed by this software?

A: Common types include:

- Market Risk: Risks from fluctuations in market prices, such as interest rates, exchange rates, and commodity prices.

- Credit Risk: The risk of loss due to a borrower’s or counterparty’s failure to meet their financial obligations.

- Operational Risk: Risks arising from failures in internal processes, systems, or human errors.

- Liquidity Risk: The risk of being unable to meet short-term financial obligations due to an inability to liquidate assets quickly.

Q: How does the software help in regulatory compliance?

A: The software helps by ensuring that financial practices and risk management strategies adhere to regulatory standards and guidelines. It often includes features for tracking compliance, generating necessary reports, and maintaining documentation to meet regulatory requirements.

Q: What should organizations consider when choosing financial risk management software?

A: Organizations should consider factors such as:

- Integration: How well the software integrates with existing systems.

- Scalability: Whether it can grow with the organization.

- User-Friendliness: The ease of use for different stakeholders.

- Features and Functionality: The specific risk management features required.

- Cost: Budget constraints and the total cost of ownership.

- Vendor Support: The quality of customer service and support from the software provider.

Q: Can financial risk management software be customized?

A: Yes, many financial risk management software solutions offer customization options to fit the specific needs and requirements of an organization. Customization can include tailored reporting, specific risk models, and integration with other business systems.

Q: What are the benefits of using financial risk management software?

A: Benefits include improved risk assessment and decision-making, enhanced compliance with regulations, better management of financial exposure, and more efficient reporting and analytics. It also provides a systematic approach to risk management, helping organizations anticipate and respond to potential financial challenges.